How to Get Pan 2.0 Online: The Permanent Account Number (PAN) card is an essential document for individuals and businesses in India, crucial for tax compliance and tracking financial transactions. To streamline and enhance security, the Income Tax Department introduced the How to Get Pan 2.0 Online. This upgrade includes a new QR code for rapid online verification and promotes a paperless, digital experience.

This article provides a detailed overview of How to Get Pan 2.0 Online, covering its features, benefits, and the application process. Whether you’re a new applicant or a current PAN cardholder, understanding How to Get Pan 2.0 Online will help you the advantages of this improved system.

What is PAN Card 2.0?

PAN Card 2.0 is the Income Tax Department’s initiative to modernize the issuance and management of PANs. Under this program, applicants receive an e-PAN card with a secure QR code sent directly to their registered email at no cost. A nominal fee applies for a physical PAN card. Importantly, existing PAN cards remain valid even without the QR code.

PAN 2.0 Project Overview

Launched by the Income Tax Department, the PAN 2.0 project aims to upgrade the PAN system using advanced technology, notably the inclusion of a QR code. Approved on November 25th, 2024, by the Cabinet Committee on Economic Affairs (CCEA) with a financial outlay of Rs. 1,435 crore, the project’s core objective is to digitally enhance the PAN card system towards a fully paperless, streamlined, and technology-driven process. Aligned with the government’s Digital India vision, PAN 2.0 aims to improve service delivery, ensure better security, and provide a seamless digital experience to taxpayers.

Features of PAN Card 2.0

The new PAN Card 2.0 system introduces several key improvements to enhance security and combat fraud, including mandatory Aadhaar linkage, real-time data validation, and advanced analytics. Key features include:

- QR Code Integration: Provides quick verification and easy access to taxpayer information.

- Unified Digital Platform: Consolidates all PAN-related services for easy online management.

- Enhanced Cybersecurity: Protects taxpayer data from unauthorized access and breaches.

- Eco-Friendly Operations: Reduces environmental impact and operational costs through paperless processes.

- Secure PAN Data Vault: Ensures safe storage for entities using PAN data, enhancing privacy and security.

- Mandatory Aadhaar Linkage: Improves verification and fraud prevention.

- Real-Time Validation: Enhances accuracy and reduces errors.

- Advanced Data Analytics: Helps detect and prevent fraudulent activities.

Benefits of New PAN Card 2.0

The updated PAN Card 2.0 offers several advantages:

- Enhanced Security: The QR code contains encrypted personal information, making it difficult to alter or duplicate the card.

- Streamlined Verification: Instant scanning of the QR code allows for quick and accurate identity validation.

- Updated Information Maintenance: User details are synchronized with the latest formatting and requirements of the Income Tax Department.

- Fraud Prevention: The QR code’s advanced encryption prevents unauthorized duplication.

- Regulatory Compliance: Aligns with updated government protocols and security measures.

- Digitized Application Process: Reduces paperwork and simplifies the application process.

- Eco-Friendly Operations: Promotes a paperless system, reducing environmental impact.

- Accessibility for Updates and Corrections: Free application option for updating details like name or date of birth.

Documents Required for PAN Card 2.0 Application

To apply for a new PAN card 2.0, you will need the following documents:

- Proof of Identity (PoI):

- Aadhaar Card

- Passport

- Driving License

- Voter ID Card

- Proof of Address (PoA):

- Bank Statements (Recent, within the last 3 months)

- Rent Agreement (If applicable)

- Utility Bills (Recent, within the last 3 months – electricity, gas, water)

- Aadhaar Card (If it has the current address)

- Proof of Date of Birth (DoB):

- Birth Certificate

- School-Leaving Certificate

- Passport

Ensure all documents are up-to-date, accurate, and meet the requirements to avoid processing delays.

What is Difference Between PAN Card and PAN Card 2.0?

| Feature | PAN Card | PAN 2.0 |

| QR Code | No | Yes |

| Format | Physical | Physical+ Virtual |

| Security | Basic | Enhanced |

| Cost | Charge | Free |

| Delivery | Slower | Instant (e-) |

Eligibility for PAN Card 2.0

- Existing PAN Cardholders: Automatically eligible for the PAN 2.0 upgrade and can request the new QR-enabled PAN without reapplying.

- New Applicants: Must meet the standard eligibility requirements by providing the documents listed above.

How to get Pan 2.0 Online – Step-by-Step

All existing PAN cardholders are eligible for PAN 2.0. You can request the QR-enabled version through the official channels of NSDL and UTIITSL.

- Determine Your PAN Issuer (NSDL or UTIITSL): This information is found on the back of your existing PAN card.

- Apply Online: Choose the appropriate process based on whether your PAN was issued by NSDL or UTIITSL.

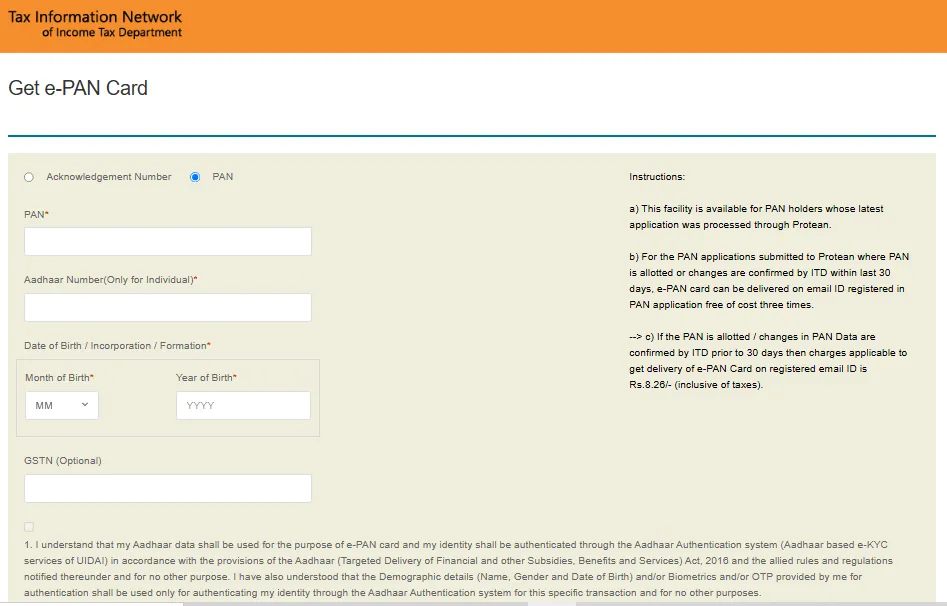

How to apply online PAN 2.0 from NSDL Website

- Step 1: Visit the NSDL Website: Go to the official NSDL PAN Request Page.

- Step 2: Enter Your PAN and Personal Information: Provide your PAN, Aadhaar number (mandatory for individuals), and Date of Birth.

- Step 3: Choose the OTP Delivery Method and Validate the Details: Receive an OTP via email or SMS and enter it to validate your details.

- Step 4: Agree to Terms and Conditions: Read and agree to the terms.

- Step 5: Payment and Final Submission: Pay the nominal fee (if applicable) and submit your application.

How to apply online PAN 2.0 from UTIITSL Website

- Step 1: Visit the UTIITSL Website: Go to the official UTIITSL PAN Request Page.

- Step 2: Enter Your PAN and Personal Details: Enter your PAN, Date of Birth, and Captcha Code.

- Step 3: Check for Registered Email ID: The system will confirm if your email is registered. If not, you’ll need to update it (which will be free once the PAN 2.0 project is fully implemented).

- Step 4: Request e-PAN: Choose between a free e-PAN (if issued within 30 days) or a paid e-PAN.

- Step 5: e-PAN Delivery to Your Email: After confirmation and payment (if applicable), your e-PAN will be sent to your email in PDF format.

Conclusion

PAN Card 2.0 represents a significant improvement in simplifying and securing the Indian tax system. Its enhanced features, paperless processes, and improved security offer taxpayers a more seamless and efficient experience. By embracing PAN 2.0, you’re taking a step towards a more secure and convenient future for managing your financial and tax-related activities.

How to Get Pan 2.0 Online: Some Important Links

| Pan 2.0 Update | NSDL || UTIITSL |

| Pan Reprint Status Check | NSDL || UTI |

| Reprint Pan Card | NSDL ||UTI |

| Pan Card Address Update Free | NSDL || UTI |

| Official Website | Click Here |

| Homepage | Click Here |

FAQ:-

What is PAN Card 2.0?

It is the upgraded version of the Permanent Account Number (PAN) card, featuring a QR code for faster and more secure verification.

Do I need to apply for PAN Card 2.0 if I already have a PAN card?

While not mandatory, it is recommended to obtain the PAN 2.0 for enhanced security and benefits.

Is there a cost to get PAN Card 2.0?

The e-PAN is free, but there is a nominal fee for a physical PAN card. If your e-PAN was issued more than 30 days ago, a small fee will be applicable.

What documents are required to apply for PAN Card 2.0?

Proof of Identity (PoI), Proof of Address (PoA), and Proof of Date of Birth (DoB) are required. Aadhaar is commonly used.

What is the benefit of the QR code on PAN Card 2.0?

The QR code allows for quick and secure verification of your PAN details.